The positive LMIA is provided to the foreign worker to submit with hisher application for a work permit which is typically issued for one year if granted. This Act was first adopted in 1912 and provides compensation to workers who suffer an injury on the job and protects employers liability.

Being posted to or hired in Luxembourg as a highly qualified worker.

. TSLAQ a loose collective of anonymous short-sellers and skeptics of Tesla and Elon Musk regularly discusses and shares news of these. Suitable employment pre- injury hours and days. As part of the heightened measures for COVID-19 all walk-in and in-person servicing requests and meetings will be by appointment only.

Prompt adequate and. Tax relief for unavoidable and extraordinary expenses. LMIAs are overseen by Employment and Social Development Canada ESDC and have an associated application fee of 1000 for each temporary foreign worker position applied for.

It is widely accepted that human resources of an organisation give it an edge over its competitors. Deducting gifts or donations. The mission of the Workers Disability Compensation Agency is to efficiently administer the Act and provide prompt courteous and impartial service to.

A lump sum compensation payment is made by you or an insurer for pain and suffering. Use this field if. Employers are required to apply for Check Out Memo for the repatriation of the foreign worker.

Failing which the foreign worker will not be allowed to stay and work in this country. COMMON LAW AND THE EARLY INDUSTRIAL REVOLUTION The development of English common law in the late Middle Ages and Renaissance provided a legal framework that persisted into the early Industrial Revolution. Earlier this Act was known as the Workmen Compensation Act 1923.

Total labour cost consists of compensation of employees received by the employee labour income of the self-employed other labour-related costs eg. However BIDA may introduce the policy-based financing scheme including a loan scheme such as Export Development Fund. Effective 1 January 2019 employers who hire foreign workers shall register their employees with Social Security Organisation SOCSO and contribute to the Employment Injury Scheme under the Employees Social Security Act 1969 Act 4.

What should I do. There is any variance in wage eg bi-monthly union dues fringe deductions etc. Attracting the Talent Retaining the Talent and Motivating the Employees.

By the employer concerning variations in working hours on a daily and weekly basis when the average working hours scheme. A performance-linked incentive PLI is a form of incentive from one entity to another such as from the government to industries or from an employer to an employee which is directly related to the performance or output of the recipient and which may be specified in a government scheme or a contractPLI may either be open-ended which does not have a fixed ceiling for the. This is a partial list of lawsuits involving Tesla Inc the American automotive and energy company since 2008.

If you require assistance please contact us at 1800-LIBERTY 5423 789 or through our online form under the Email Us tab here. Working out the withholding amount. Requesting a tax allowance for extraordinary expenses.

Wage Credit Scheme and Jobs Credit Scheme that are provided to the employers. Foreign Worker Levy and net training cost incurred by the employers and wage subsidies eg. 1 Attracting the Talent.

An honorable lord would care for his injured serf. You wish to name a source other than your organization who is paying the foreign workers wages such as a foreign contracted company. If worker has current capacity but is not working ie suitable employment not performed then a Time lost record must be reported.

Slip of Foreign Workers Compensation Scheme FWCS Foreign workers must undergo a medical examination and be certified fit by the clinic medical center. The Employees Compensation Act 1923 is an Act to provide payment in the form of compensation by the employers to the employees for any injuries they have suffered during an accident. All gross income before tax from your everyday business activities including sales made over the internet income from sales cash and electronic and foreign income gross income doesnt include goods and services tax GST.

Am I obligated to pay for the entire course of treatment. Weekly compensation payments are made by an insurer to an injured self-employed worker made under a policy held by that worker. The employer must pay you a habitual and reasonable compensation.

The Act on Posting Workers 4472016 provides provisions on posted workers. Benefiting from the tax regime for highly skilled and qualified workers. The rate of contribution is 125 of the insured monthly wages and to be paid by the employer.

Setting Up Length of Service Bands. A posted worker works for a foreign enterprise and temporarily in Finland. Use the Accrual Bands window to define length of service bands for an accrual plan.

The concept of compensation for the worker was bound up in the doctrine of noblesse oblige. Choose the Net Calculation Rules button to view or change the rules for calculating employees net PTO. If worker has current capacity and is working ie.

My WP holder requires long-term medical care. Deducting premiums paid to a supplementary pension scheme. When calculating your businesss assessable income include.

Select YES if the accrual plan is foreign worker plan and then link the standard accrual plan to this foreign worker plan. What are the upcoming changes to the foreign workforce policies for the construction sector from 1 Jan 2024. All other business income that is not part of your everyday business activities including.

Foreign worke at the initial stage and then 201 during the operational stage. If a worker has only been in the following situations then a time lost record must not be reported. My worker was informed that his Work Permit is suspended due to levy default but I did not get such a letter.

An organisation has to design its compensation system to attain the following purpose. Generally industrial projects registered with BIDA can employ foreign workers at a ratio of 101 local worker. As of December 2021 Tesla is party to over 1200 lawsuits and as of September 2021 it is party to 200 in China alone.

A lump sum compensation payment is made by you or an insurer following the death of an employee.

How Workers Compensation Fraud Games The System National Insurance Crime Bureau

Http Video Bgnes Com View 36058 Best Funny Images Funny Images Birthday Images Funny

New York Workers Compensation Laws Made Simple New For 2022

Employment Injury Scheme For Foreign Worker

Workers Compensation Insurance Norway If

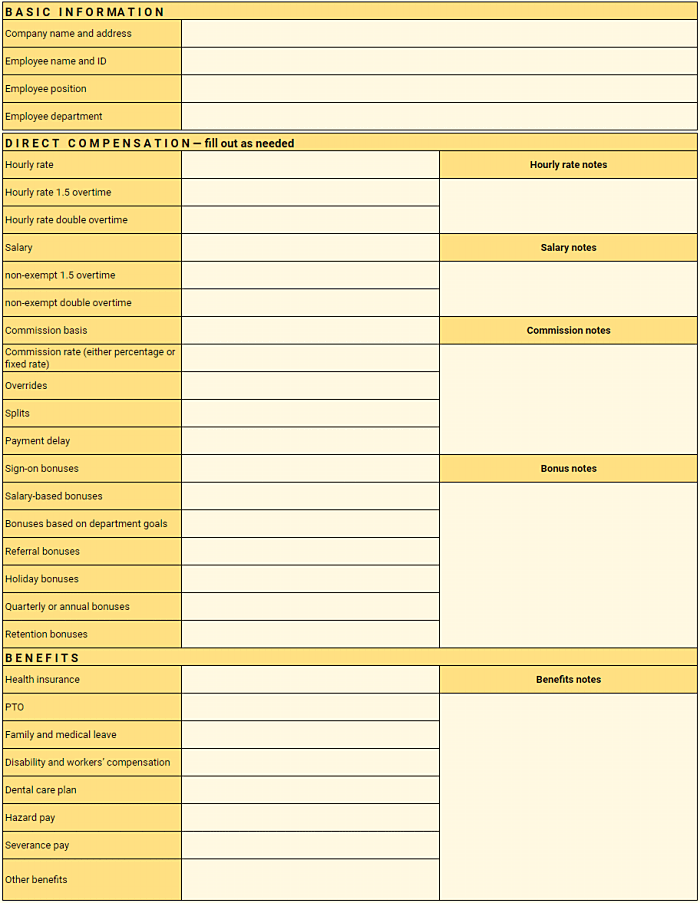

A Guide To Employee Compensation

Social Protection For Foreign Worker

Workers Compensation Insurance Norway If

Are Professional Athletes Entitled To Workers Compensation

Do Sole Traders Need Workers Compensation Insurance

Workers Compensation Overview And Description Video Lesson Transcript Study Com

How To Make An Employee Compensation Plan With Templates Clockify Blog

Foreign Workers Compensation Scheme Fwcs Business Insurance Progressive Insurance Bhd General Insurance Company In Malaysia

Workmen S Compensation Insurance Coverage Claim Exclusions

Workers Compensation Fund Control Board

Workers Compensation In Canada Safeguard Global

Homebuyers To Get Compensation For Delays In Possession Of Apartment In 2022 Home Developers Home Buying Compensation

Workers Compensation Insurance Finland If